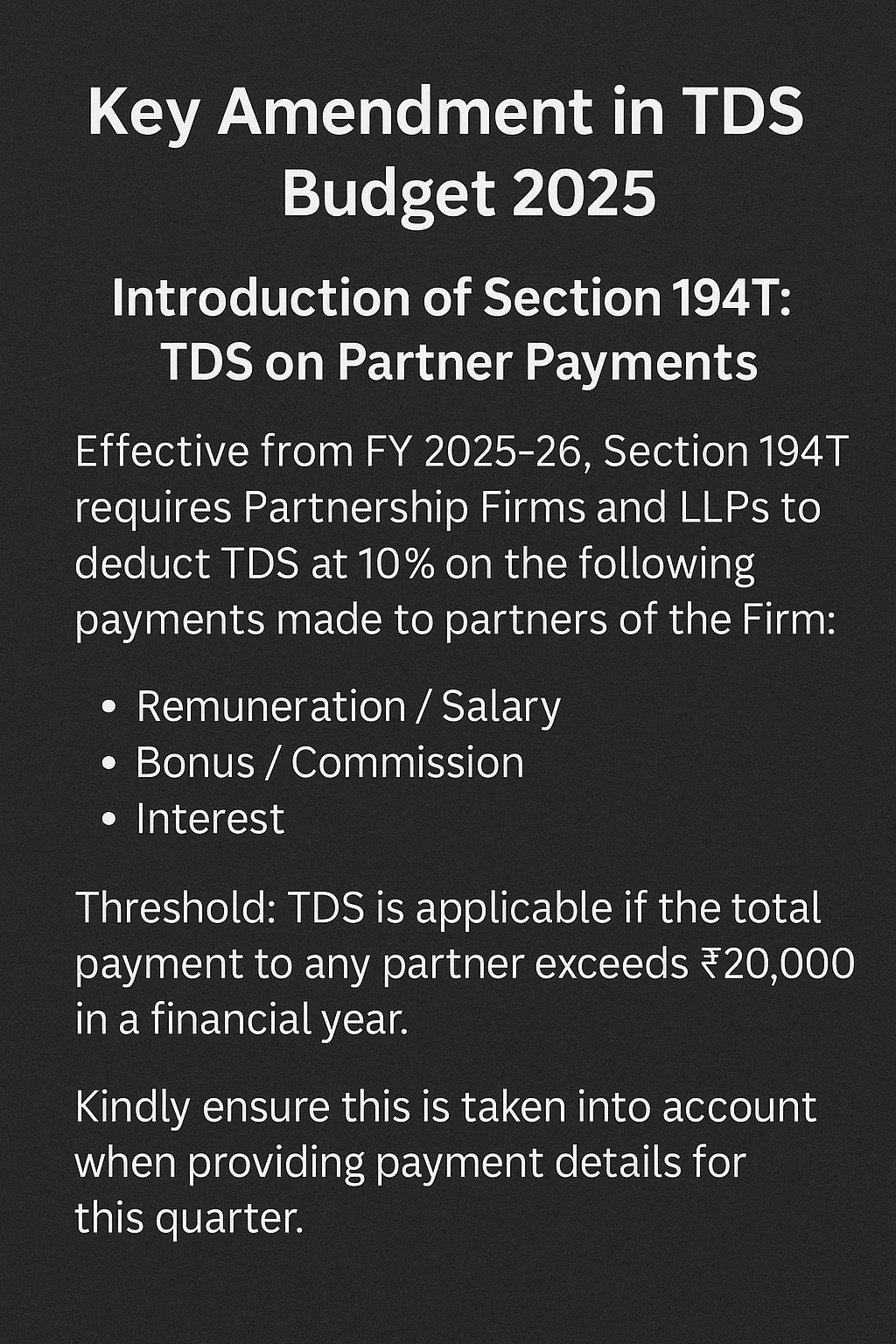

Introduction of Section 194T and its thereshold limit

Effective from FY 2025-26, Section 194T requires Partnership Firms and LLPs to deduct TDS at 10% on the following payments made to partners of the Firm:

1. Remuneration / Salary

2. Bonus / Commission

3. Interest

Threshold: TDS is applicable if the total payment to any partner exceeds ₹20,000 in a financial year.

1. Remuneration / Salary

2. Bonus / Commission

3. Interest

Threshold: TDS is applicable if the total payment to any partner exceeds ₹20,000 in a financial year.